As you may have already heard, we have recently opened a second, even larger Black Hops brewery on the Gold Coast, Black Hops II. To get us over the line we used equity crowdfunding which has recently become approved in Australia for Pty Ltd companies.

Running a brewery is an expensive game, and we’ve always been transparent in how we’ve gone about raising the funds we’ve needed to prosper, from our very first podcast where we recorded conversations with potential investors, through to our $400,000 raise for the first Black Hops expansion. We even broke down all the costs of building the brewery and how we fared against our budget in our book, Operation Brewery.

We’ve also always been quite keen on crowdfunding. Our first brewery in Burleigh was kick started via a rewards based crowdfunding campaign on the Pozible platform in 2015, an Australian first, which raised $18,000 towards our start up costs.

We think equity crowdfunding is going to be a big part of how breweries raise funds in Australia so we thought we’d share some of our experiences.

Equity crowdfunding in Australia so far

Equity crowdfunding has been around for a long time overseas, but it only became legal in Australia towards the end of 2018.

We recently published a detailed rundown on the ins and outs of equity crowdfunding, as well as addressing some common questions on the topic. Check it out here.

Whilst rewards based crowdfunding helped us out immensely when we launched our first brewery, we saw a lot more benefits this time around in using equity crowdfunding. At the time of our raise there had been a few companies in Australia to run campaigns, with promising results. Endeavour Brewing Company had their campaign live, West Winds Gin raised $932k and DC Power and Xinja both raised more than $2m in their campaigns on Equitise.

Still despite the amounts raised, before our campaign I felt as if the Australian projects hadn’t really captured the idea of equity crowdfunding quite like some of the overseas ones. The ones I liked from overseas had told a fun genuine story and had successfully maxed out their full allocation in a matter of days. They resulted in fantastic PR for the companies involved and formed part of their story going forward. That to us represented a successful equity crowdfunding round so that’s what we set out to achieve with our campaign.

Our approach to equity crowdfunding

Having researched a number of successful equity crowdfunding campaigns around the world across a range of businesses, I’ve come up with a few key principles on achieving the best results via this medium, which we applied to our initial Black Hops equity crowdfunding campaign.

First up, I think it’s important to go hard, launch your campaign with a bang and get some early runs on the board with an eye-catching upfront result. Hitting a minimum target quickly gives you something to shout about upfront and provides invaluable momentum. A lot of press outlets weren’t going to rush to cover our campaign launch, but when we hit our minimum target in record time (8 hours and 15 minutes) that really became a powerful story and more press outlets jumped on board.

With our rewards based campaign we had aimed to hit 30% of our target on day 1 to give people certainty that the project would be successful. With equity we aimed to hit our minimum target of $150,000 on the first day (which we did). This not only gives people confidence the project will be a success, it also drives a healthy amount of fear of missing out. If we were at $150,000 in 8 hours, and our max was only $400,000, then it means there is a real risk of missing out on the investment.

We had no intention of our campaign dragging on for months. There’s a few reasons why I think this is the best approach when it comes to equity crowdfunding. First up, it gives your offer an air of exclusivity, which makes people desire it more. Also, if people feel like they might miss out if they don’t act quickly, they’re more likely to act, full stop. If something is readily available for months on end, human nature kicks in and people will tend to ‘put if off till later’. Which may mean, not at all. I also don’t think it’s a great look for a brand to be publicly available to anyone for months and months. I’d much rather reduce the potential maximum and have a short and sharp campaign where not everyone is able to take part. It means there is some healthy desire for next time as well and with a brewery there’s a real chance that another raise will be needed in the future.

Under the terms of the current legislation you can raise up to $5 million each year. So why not raise a small amount now and run another campaign later on if need be.

Doing an equity crowdfunding raise is also a hell of a lot of work and can be a big distraction so ending the campaign early enables you to move onto other things.

This is exactly how some of the best overseas exponents of equity crowdfunding, such as Scottish trailblazers BrewDog and their equity for punks campaign, have gone about things. By making your offer somewhat exclusive and desirable, people who may miss out this time will be frothing to come onboard next time. So we think setting a realistic and achievable maximum target is the way to go.

For our campaign we set ourselves what we believe is a challenging but realistic and effective maximum target of $400,000.

Pre-campaign

While tapping into the equity crowdfunding road was always a given for Black Hops, to maximise our chances of success we undertook a rigorous process of due diligence for every step of the journey.

Pre-content

Over many years we’ve put content out about crowdfunding and equity crowdfunding. It was a key part of our story. We wrote blog posts, we covered it in our book and we did external events and content too. In 2016, I joined a brewery startup panel where crowdfunding was a hot topic. Here is a summary of the event on Crafty Pint. In this 2017 article in the Sydney Morning Herald, I discuss the incoming equity crowdfunding legislation. I also attended and spoke at the launch of equity crowdfunding platform, Birchal, in 2018. This was all a long time before our campaign but it meant that when it came time to run the campaign, we had built up some trust in the space and the crowdfunding idea was part of our story.

Industry and platform research

In the lead up to equity crowdfunding becoming legal in Australia, we jumped on the front foot and made sure we were up to speed with the pending legislation. We also started reaching out and building relationships with equity crowdfunding platforms, in particular Birchal, an offshoot of Pozible, who we went with for our rewards based crowdfunding campaign in 2015.

We also weighed up the pros and cons of the two other major platforms in this country, Equitise and OnMarket. We examined their respective merits from a number of angles, including their fees and biggest fund raises, as well as looking at camparible campaigns they’d hosted in the beer or alcohol industry. There wasn’t much between them, but in the end we settled on Birchal as our platform of choice. I’d say the main reason was we had worked with the team there before and we knew them to be great people and very good at what they do, and they were also part of our story already given they are the same team behind Pozible.

I have to say we were very happy with our choice, Birchal were amazing throughout the whole process. There have also been some big and successful campaigns on the other platforms so do your research and choose one that works for you.

Setting goals

We also thought it important to specify some clear and measurable goals around what we wanted our campaign to achieve. Here were our three key goals, which we’re pleased to report that we were able to achieve.

- to be Australia’s first equity crowdfunded brewery.

- to be the fastest crowdfunding campaign to hit it’s minimum ($150k) and maximum ($400k) targets.

- to generate a decent number of investors and supporters and a decent amount of positive press for the company.

In addition to those things, we wanted to present our brand well in the video and in the press stories, tell our story and come out of it looking better than when we went into it.

Pre-offer support content

Before we even launched our campaign we already did quite a bit of content and interest building around the idea of investing. We had done some articles on the blog, we had a landing page up for ‘investing in Black Hops’ which had gathered 1,200 email opt ins.

We had also shared some behind the scenes stuff on social media so it was no surprise when we launched the campaign. You can see our investment page here (we continue to build a list of people interested in owning shares in Black Hops). I’ve also put a screenshot below. It includes an email opt in and some associated content.

Crowdfunding video

The video is a huge part of a campaign. Since the whole effort is as much a PR exercise as a financial exercise, doing a great video is critical. A lot of the people who watch it may not even be in a position to invest but they will still be influenced by the content if you do a good job with the video.

We started out by looking at a bunch of videos from other campaigns and discussing what we liked and didn’t like. Here are a few campaign videos that we liked:

We worked with Desert Island Media, a great local company who helped us capture our ideas in video form. To start with we reviewed a bunch of videos from other campaigns and discussed what we liked and didn’t like.

For our video we wanted to leave out too many technical and financial details and just focus on telling our story in a genuine way. We wanted to avoid awkward face to camera stuff and just have us all tell our story and have our videographers pull out bits from each of us and put it together in a story.

Here were some of our notes about high level things to consider for our own video:

Inclusions

- AIBA Award footage, general gold medal results, GC Entrepreneur awards. Could just have a short section saying something like “We’ve managed to get a fair bit of recognition since our humble beginnings” and have some things flash up like the GC Entrepreneur award, Oktoberfest award and the AIBA Medals. Then say something like “But winning the 2018 AIBA Champion Small Brewery was a real highlight”, then show either the image or some video footage of that.

- Footage of the taproom and business processes like canning / beer delivery etc.

- Inclusion of the team, make sure it shows our diversity (we have an awesome team!).

- Possibly mention the industry opportunity which is a big part of it but don’t make it too business.

- Show a visual chart of revenue growth. We have a nice line chart we can use for this.

- Would be nice to show some customers too and mention how awesome they are. Would be even better to include some video interviews if we can but I don’t want it to drag out too far.

Sentiments we’d like to capture

- We love beer and the whole craft beer movement

- We have a legitimate story and a genuinely unique brand

- We get shit done and aren’t the type to sit around and wait for everything to be perfect before acting. This campaign is to help us finish the project not give us some hope that we can start it.

- Our beer is as good as beer gets in Australia and that is important to us.

- Would be good to cover the pilot system and some of the experimental brews we’ve done as part of the HQ or BHII walkthrough, to make sure people realise we are very relevant in the craft beer scene.

- Focus on team, lots of footage of the team in additional shots, show us as a big happy diverse team and not just 3 dudes

- Show the scale of our growth. One keg to first commercial brew on a system the same size as our new pilot system to gigantic tanks etc

Videographer questions

Here are some questions to load the videographer up with to get the responses we need.

- Backstory – How did Black Hops start?

- First beer – Run through the initial tasting of the Eggnog stout

- What makes Black Hops different? (great beer, genuine brand and story, experimental 52 beers this year)

- How did you feel seeing the big tanks go in to BHII?

- What have been some of the highlights of the journey (AIBA Award)?

- Describe Black Hops growth to date

- Describe Black Hops approach to beer making

- What do you love about the craft beer industry?

- Why are we doing crowdfunding now?

We decided to film it in a few scenes that showed our progression from homebrew to our huge new brewery.

It’s very easy to critique other people’s videos but doing videos well really isn’t very easy. In the end here is the video we came up with. We did it in 1 week and had it ready the day before the campaign launched.

Valuation

Any time you are raising money for a business, the valuation you are raising at is at the centre of the raise. It’s something you have to think long and hard about. You will never get it right but depending on how the raise goes, you’ll know at the end whether you set it too high or too low. There are benchmarks you can use to figure our valuations, however in our case we’ve moved away from those a little bit because we feel that the trajectory of the business and the strength of the brand are ultimately what matters, and those are very hard to capture in industry benchmarks.

The only advice I can really give here is just try to objectively look at your business vs others that have gone before you and try to figure out a valuation that feels right. Just don’t undervalue your brand. It’s very difficult to build a brand in this industry and if you are running a campaign for a brand that has already got some traction then you have to place a good amount of value on that.

We chose a pre-money valuation of just under $18m for our raise. The fact that we raised the maximum amount in 6 days tells us we were about right on the valuation if not a little bit under what we could have raised at.

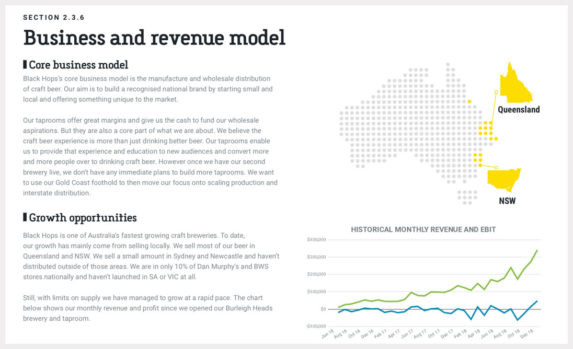

The Offer Document

Putting together the offer document was a lot of work. We had raised money before so we had a general structure for how to tell our story in that format. However there are a lot of ASIC requirements with the Equity Crowdfunding offer document so we had to work very closely with Birchal to get everything in there. There was a lot of back and forth. We started by taking the template from Birchal and filling it out with our information from our past financial prospectus docs – updated for the present time. After a lot of back and forth we got our designer to bring it into a nice format for the campaign.

You have to be particularly careful not to include anything that is potentially misleading in there. We stayed away from too much discussion around future projections and focused more on our historical financials and high level plans for using the money. We had input from our team, Birchal, our accountants, our finance guys, our designers and more. It was quite the process putting that document together but we managed to do it in a couple of weeks and have it ready just in time for launch.

You can still download our offer document from the investment page on Birchal, just keep in mind the offer is no longer open.

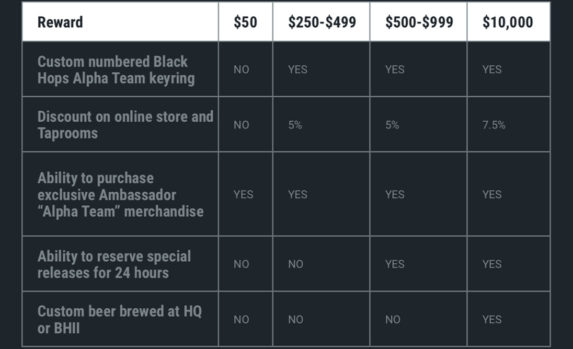

Investor Rewards

While this isn’t a rewards based campaign, it’s still worth putting effort into some decent rewards as people are still very much motivated by exclusive benefits to being an investor. In our case we didn’t want to offer huge discounts so we did offer some discounts but we mainly focused on special things we could offer investors that they couldn’t get elsewhere. Here are the rewards we came up with.

We structured them to encourage people to at least invest $250 (which would give them a keyring and taproom discount), and kept some of the bigger more exclusive rewards for people who invested more (the custom beer for example).

Crowdfunding campaign

Expression of Interest process

Birchal’s normal process for these campaigns is to run their own Expression of Interest (EOI) process where they build a list of people who are opting in because they are interested in investing. Then when you launch you have a nice list to market to. They normally run some paid ads to start testing traffic sources and start pushing the press once the EOI is live. In our case since we’d already done our own EOI process of sorts (our investment page and associated email list), we only did a very short EOI process with Birchal. We excluded people from our audience and our email list, and instead focused on new potential backers. This ran for the week prior to launching so on launch we both had a list of people to market the campaign to. We kept our list up to date with what was happening and told them when to expect the live campaign.

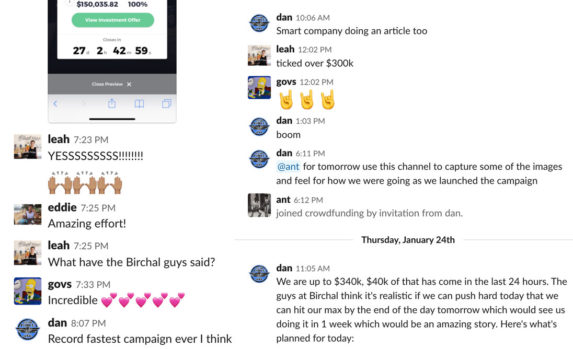

Private Launch

The idea behind a private launch is to get the campaign started behind closed doors and build up a bit of investment before you go out and promote the campaign publicly. When you do you will hopefully have some proof and it’s a better look when the press and potential backers are looking at the campaign page. Normally these campaigns run for about a week to enable the campaign to get close to its first target. In our case we hit our first target within 8 hours and 15 minutes of launching privately so we made it public very quickly. Once it was public it was clear this was taking off. It was very cool to see the funds rolling in after months of work building up to the campaign. We were also at a critical point in the brewery build where we needed the funds so it was a great sense of relief for it to be going well.

Here is some of the activity captures from our #Crowdfunding Slack channel.

Press

As mentioned, getting positive press and attention is a big part of doing equity crowdfunding. It brings great attention to the industry and allows you to spread your story far and wide, so it’s important to manage this part of the project well. For us we didn’t push the press too hard because we were confident the project would go well and once it did, we knew the press would be more likely to write about it.

We did however build a list of press contacts and reach out to them to tell them it was coming. Birchal played a big part in this by going through any articles written about Black Hops in the past and coming back to us with a list of contacts. We added our own in and we began reaching out to people. Birchal lined up a few big outlets including the Australian Financial Review and as the campaign began breaking records we got more and more press. In the end we ended up in business and finance publications, beer blogs and podcasts, local radio and TV.

Here are a few of the articles that came out around the time:

- Beer and Brewer: Black Hops Reaches Crowdfunding Target

- Crafty Pint: Black Hops Sets Crowdfunding First

- Business News Australia: Black Hops Completes Crowdfunding in Just 6 days

We also had new stories on Channel 9 and 7 (which were both followed up on when we launched the brewery) and articles in The Australian, The Australian Financial Review, the Herald Sun and the Gold Coast Bulletin (all behind paywalls which is why we aren’t linking to them).

Post Campaign

The results

In the end we were stoked with the results from our campaign. We were blown away that even before we shared it we had investments coming in. We had our core taproom customers investing and some more seasoned investors who liked the deal. We hit the goal within 8 hours and 15 minutes, the fastest campaign ever in Australia to hit their goal. We launched publicly on the Monday launching the video and by the end of that day we were up around $250,000.

By Thursday we were at $340,000 and Birchal suggested they thought we were a real chance to hit our maximum target of $400,000 by the weekend. We had the IBA meeting that night at Aether brewing which all 3 of us founders went to and got a text mid-meeting to let us know we had hit the target that night.

We snapped a selfie and sent it to the Birchal guys and cheers to a job well done.

In the end we raised the $400,000 in 6 days from 540 investors, the first Australian brewery to complete an equity crowdfunding raise and the first company in Australia to hit its maximum equity crowdfunding target.

That was late January and within 2 months the brewery was open to the public with the funds from the crowdfunding enabling us to finalise the project.

Investor integration

Once the campaign is over there is still a lot of work to do. Not only do you need to work out how to implement a new mechanism for managing hundreds of shareholders, you also need to distribute the rewards and keep the new investors happy. We’ve been working on putting together our limited release Alpha Team shirts which should be coming through this week and we’ve put all investors into our systems for taproom discounts etc. We’ve also been keeping them up to date via email and have managed to meet quite a few face to face at our taprooms.

Conclusion

Hopefully this was a useful guide for any brewery looking at doing equity crowdfunding. We feel it is a great thing for the industry and we are happy to have played a small part in it’s launch in Australia. We are always happy to answer any questions you have. You can ask those via the Black Hops Ambassador Facebook group or hit us up next time you are at Black Hops.