It’s been around 2.5 years since we completed our Equity Crowdfunding campaign with Birchal, I thought it was a good time to look back at where things are at now, the good, the bad and some advice for other breweries considering Equity Crowdfunding.

The Good

Black Hops is almost 10 times the size it was when it last reported it’s results in our Offer Document for our crowdfunding campaign. That, and more in this section, read on!

The campaign itself

I’m proud of the campaign that we ran for a few reasons.

- Our campaign was very successful, hitting our minimum target in a matter of hours and our maximum target in 6 days.

- Because we hit our target early we became the first brewery to close an equity crowdfunding campaign (we weren’t the first to open one).

- We didn’t overcommit to a future full of big promises. We just said we would build a second brewery, and we were well on the way to doing that already when the funds came in. We’ve done that and a hell of a lot more since we completed our campaign.

- We didn’t do an Expression of Interest (EOI) where people are riled up and made excited about potentially ‘committing’ to investing before they have necessary information. I don’t believe in asking people if they will do something, I believe in making the offer and giving them the opportunity to do it.

- We supplied detailed information and I was available to anyone who wanted to chat more about the campaign (and still am).

- We didn’t try to raise too much money. In hindsight we could have raised a lot more but I’m glad we didn’t raise much more at that valuation, because the business is worth a lot more now and we would have been giving up equity too cheaply.

- On that note I’m also proud that investors who did get in at a very reasonable valuation, have seen their shares go up in value significantly (although without liquidity, see below.

- We also didn’t overcommit to investor rewards and tried to focus people’s attention on it being an investment, not just a way of getting discounts.

- Most of our investors were known to us already, many of them were taproom regulars.

- It was over in 6 days as well with very limited promotion which meant we could immediately get back to work.

The investors

We were waiting for years to allow some of our biggest supporters in the doors to invest in Black Hops. Some of these people are some of our biggest fans and friends from the very early days. We have a general group of customers and ambassadors who love Black Hops, and the investors (the Alpha team) are the leaders of the pack.

I’m interacting with investors in one way or another just about every day. Whether it’s seeing them at the taproom or at work (some are staff), phone, email or social media, our Facebook Ambassadors group or at venues (some are customers). It’s really cool and I have no regrets about enabling an extra keen group of people to have a bit more exclusive access and visibility into the business.

The power of a growing list of ambassadors

It’s often mentioned by companies who do crowdfunding that it provides an army of supporters to get behind the brand. For us, this is really meaningful. We have 3,000 ambassadors in our Facebook group and 600 investors. We also have a lot of customers and supporters and friends and family outside those groups who get behind us. Growing these groups over the 6.5 years since we launched Black Hops, has been immensely rewarding for us.

The 2 best indicators of this are things voted on by fans such as the GABS Hottest 100 Craft Beers list and the Beer Cartel Annual Craft Beer survey.

For the Beer Cartel survey we have gone from 29th, to 10th then 5th then 1st in the last 4 years in Australia’s top rated brewery.

In the GABS Hottest 100 Craft beers list we’ve gone from 113th to 20th to 14th and 14th again and then 5th last year (with 7 beers in the list).

Not that these lists are all about getting people fired up to vote, but it certainly helps to have a group of people supporting what we do.

How far we’ve come

It blows my mind how far we’ve come since we did our original crowdfunding round. I was recently answering a few questions for Birchal for their upcoming review report and I went back and looked at the FY results reported in our offer document 2.5 years ago. The recent financial year from a few months earlier we had totalled $1.4m in revenue.

At the time of writing this, our most recent financial year is just wrapping up and we are close to $14m in revenue, almost 10X the size. It’s really crazy to think about that, but it makes sense if you consider at the time we were at a small site in one location with one taproom. Now we have 4 sites, 4 taprooms, 3 breweries (5 brewhouses) and our biggest site is now multiple tenancies on our block out at BHII.

We were canning beer at HQ at the time and distributing at a small scale locally. We are now national in Dan Murphy’s and independents and stocked in all Queensland BWS, Dan Murphy’s, Liquorlands and First Choice stores. We have also released beers since that time that have surpassed the sales of our best selling beers at the time (i.e. G.O.A.T. and East Coast Haze not being too far off).

It’s been a very big 2.5 years and when we needed the money to open BHII and take a big risk on a very big upgrade, the investors who supported us are now co-owners in a much bigger company.

As a result, the share price which was $1.18 at the time has also increased a lot. Because we aren’t listed and aren’t in a liquid tradeable market, investors can’t easily buy and sell shares (more on that later). However we have done investment raises since, including one at the start of the year which was only open to our existing traditional investors. In that round we raised over $1.5m at a share price of $2.29 and we raised it in one day.

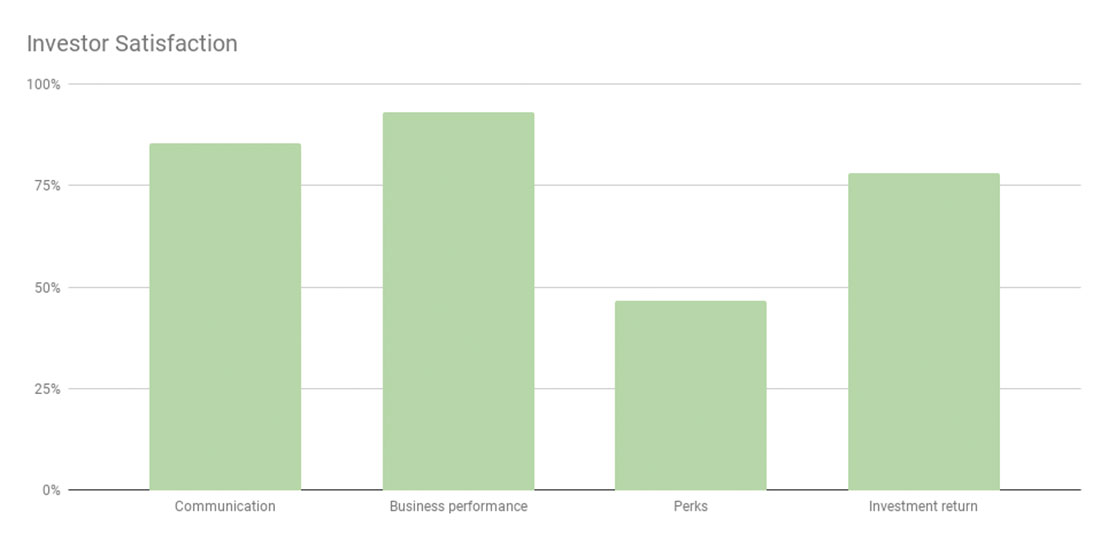

80% investor satisfaction

I recently surveyed our investors and the results came back that 80% of our investors are satisfied. That is broken up as follows:

To be honest I wasn’t thrilled with this result when I first calculated it, however considering the following things after delving into the data and contacting every investor who said they weren’t happy, I think they are good results:

- On the communications front it was clear that a lot of the people who scored this poorly hadn’t seen my quarterly investor updates because the emails were going into spam. With that sorted, I think this number is a fair bit higher and I reiterated that I’d be happy to chat with any of them any time and confirmed my contact details etc. Talking to investors is something I enjoy and I think our happiness levels in regards to ‘Communication’ should be way higher than 80%.

- On the performance front, some because of communication issues just weren’t aware of how well things had gone since the crowdfunding, so calling them and explaining it was a nice surprise. We have also done mainly quarterly updates and sometimes it isn’t clear just how much we are growing on a yearly or multi-yearly basis. I’ve now implemented annual updates so investors get a good summary at the end of the financial year and ability to ask any questions or delve further into the details.

- Perks is something we are happy to take a hit on for the reasons mentioned above. We want to hold up our end of the deal, but any suggestions of further discounts for investors we’ve directly told people are not going to happen. We are going to aim to do more beer releases for investors who aren’t close to the brewery (i.e. exclusive online beers or early access to online beers) and I think that will cheer up some investors who see a lot of what we do locally but can’t get much access to it if they aren’t close by.

- I think the investment return happiness level is about right. Share price going up is good news but if you can’t sell your shares it has little current value. There’s quite a lot of ongoing education required to explain this to investors and then there’s just the fact that sometimes investors want to sell and with the current situation they really can’t (more on that below).

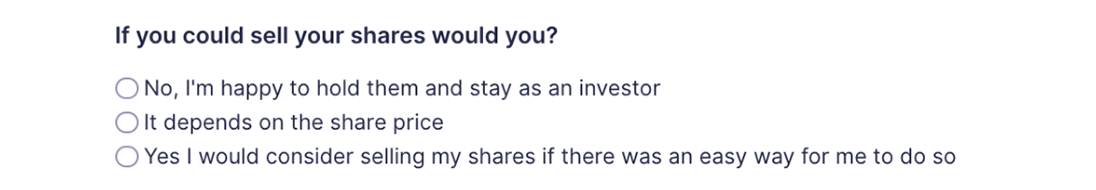

We also asked investors if they would sell their shares if they could. This was the exact question

In future I might word this slightly differently because ‘It depends on the price’ I think is a very reasonable answer to this question. That said, I was very encouraged with the results:

- 64% of investors said they would be happy to hold on,

- 34% said it depends on price, and

- 1% said they would sell.

I think this is a great outcome. It’s clear to me that investors aren’t desperate to sell and they want to stay on this rocket ship a bit longer.

Reporting

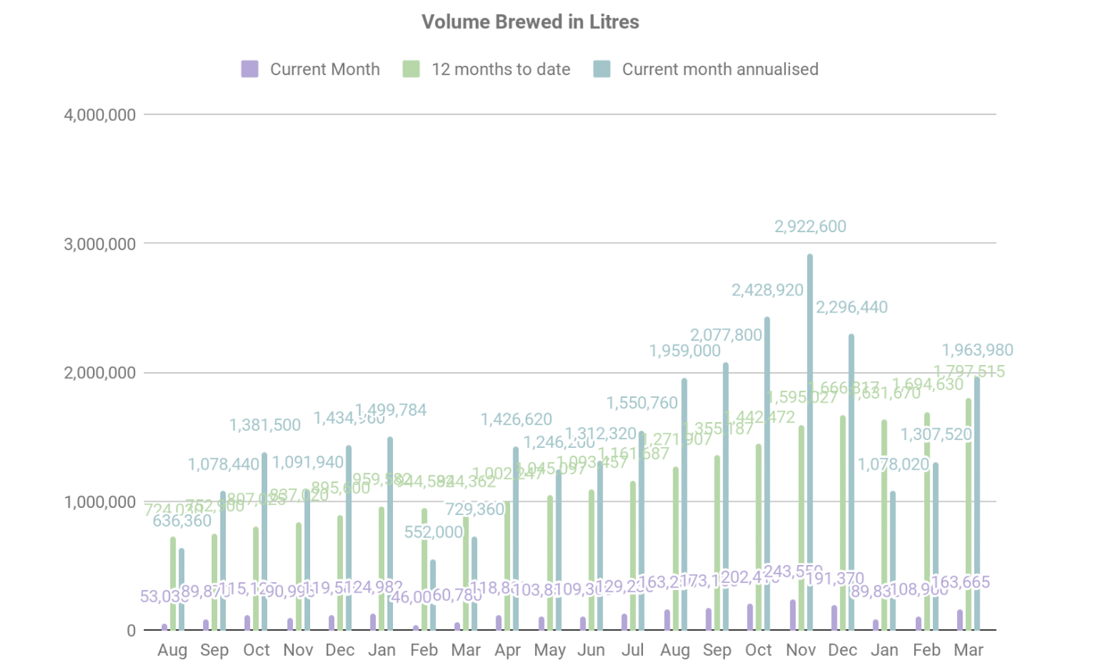

I’ve added this into ‘The Good’ section because I personally love doing our quarterly reports and I think it’s a great thing for founders to be accountable to investors and have the ability to communicate progress on a regular basis.

I do a quarterly written report to investors with a summary of key events through the quarter, an update on sales data from the sales team (with my favourite line charts), an update on the performance of the taprooms, a production update and a few other small things. I send it directly from my email address and I encourage investors to reply if they have any comments or questions. I get a lot of replies, mostly encouragement and some questions. I think it’s a great process and a healthy thing for every business to do. Here’s an example of one of the charts we include which is about brewed volume.

The Bad

I really shouldn’t call this section ‘The Bad’ because these things aren’t really bad things, they are just the realities of doing an equity crowdfunding campaign. But ‘The Good’ and ‘The Bad’ had a nice ring to it.

The effort

Running an equity crowdfunding campaign is a fair amount of work. I would say for us it was a lot less than you might think, but it’s still a fair bit more than what we generally need to do to get investment from our normal investors. Here are the main pieces of work:

- Getting the offer document right. In our case I wrote most of it myself and we have a designer who is fast and affordable who put it into a nice neat format. This was a reasonable amount of work but as you can probably tell, I don’t mind writing. The design fee was very minimal, a few hundred dollars.

- We had to update our Constitution and get legal advice, this cost around $5,000 and was a fair bit of back and forth. It was definitely a process worth going through however and thinking about all the implications of having multiple shareholders is a good idea.

- Our video cost a few grand and required the time of the founders for about half a day.

- Fulfilling the rewards was also a fair effort. It wasn’t hugely costly because we kept any physical rewards to a minimum and charged for some of the rewards (like Alpha shirts), but it was certainly a reasonable amount of work to make sure all investors got what they signed up for.

These aren’t major costs or time sucks but if we were to raise money from our existing investors I would normally just need a simple pitch deck (about 10 pages, hasn’t changed much since the article below from back in 2015), and about a 30 minute presentation. The investors already know the business backwards and we don’t need the structure that you have in an equity crowdfunding campaign.

So while the work isn’t a huge amount, it’s definitely more than we would need to raise the money from traditional investors in a healthy market when the business is going well.

Related: The pitchdeck we used to raise $100,000

The fees

The crowdfunding platforms charge 6% of the amount raised to run a campaign (and some other fees, some of which are optional). I think it’s a very reasonable amount given it’s not really possible to do a raise without using one of the platforms (unless you don’t use the CSF legislation which is another can of worms). But 6% is still a significant amount.

Our raise was only $400,000 making the fee $24,000. But if we used a crowdfunding platform to do our private round at the start of the year of $1.5m we’d be charged $90,000. That’s a hell of a lot of money. For us to do the round privately it cost us pretty close to $0. There are some fees from the accountant to draw up the deeds and update the registry, but that’s about it.

This is real money, so you don’t want to be raising often and to be honest if you can avoid spending $90,000 you’d avoid it every time.

The fees are definitely a big consideration for us when thinking about raising funds. If we were to need to raise money next year to continue on our path of upgrades, we would definitely look internally before going to CSF for this reason alone.

The distraction

While the effort for us with our campaign wasn’t huge, it was still a big ‘thing’ that lingered there for quite a while. We thought about it and talked about it for a long time leading up to it, we were busy when it happened and when pulling together all the funds and finalising the campaign and fulfilling the rewards. It was a good few months where the crowdfunding campaign was the thing we were focused on.

We’ve found as the business has grown that we are leaning towards spending less time on the fun things that people talk about a lot and way more time on the necessary and potentially boring aspects of running a pretty complicated company. We used to get super excited about every new campaign and project that came along but last year especially we learned that just the basic tasks of running a company like ours is enough work in itself. We’ve shelved projects in the last year just because we’ve felt overwhelmed with what we are taking on. Now when we take on a project such as a crowdfunding campaign, we really have to think about whether we need the distraction and can handle it. Even if the actual workload is not overwhelming, it’s yet another thing to add to the management meeting each week and discuss on social media and focus the attention of key staff for a few months. Sometimes you just don’t need the distraction.

Other potential challenges

I’ve made this section to discuss things that other people have mentioned as bad things or challenges about crowdfunding but things that we didn’t find particularly problematic.

Revealing your sensitive information

This is one of the biggest reasons people don’t want to do Equity Crowdfunding, they don’t want to reveal their business info to the public. For us, it’s in our DNA to share what we learn as we build Black Hops and sharing things like our recipes, our approach to building the business, the size of the business etc is second nature, so this wasn’t a big issue.

I also feel that it’s a step in the right direction given that every listed company in the country has to reveal these things quarterly, so why not start now.

I do fully understand that this isn’t how other companies work though, so it’s a consideration.

Dealing with investors / reporting results

It’s a pretty common narrative that crowdfunding is an issue because you have to deal with loads of investors. Like I mentioned above, this isn’t something that we’ve found is particularly challenging. We love chatting with investors, and our crowdfunding investors are not super demanding. We enjoy the annual Alpha day and brew and I enjoy sending out the quarterly reports and engaging with investors on the results. I think it’s very healthy for a business or the founders of a business to have a reporting relationship to someone other than the founding group and the investors serve as a great option for this.

Investor expectations

Investor expectations is another potentially challenging aspect of doing equity crowdfunding. I personally think that investor rewards shouldn’t be too generous and for an equity-based campaign the focus should be mainly on the opportunity to own part of the business. In our campaign we had some small rewards but it wasn’t a huge focus of the campaign. Here is how we manage the most common issues:

- Investor discounts – We have small discounts available to investors that we manage with coupons on the website and via their profile in Square for the taprooms. Any time investors ask for more discounts I tell them as an investor they should be wanting us to make money not give away discounts. I think this is the best approach, however it doesn’t result in 100% satisfaction.

- Available beers – We have some investors wanting exclusive beers, this is particularly the case if they aren’t local. This can require some managing, but it’s also a good opportunity to have an exclusive group to provide for. It’s something that requires effort to manage, but I would say the benefits are worth the effort.

- Liquidity – Liquidity often comes up as being a challenge with equity crowdfunding. The wisdom is “what value are the shares if there isn’t a market where you can easily sell them?”. I think this is a valid challenge but it’s not without solutions. For example if you changed to a public unlisted company you would be able to provide the facility for investors to buy and sell shares. It’s no small task so it’s not for everyone. However it’s also worth considering that at least in our case, our investors for the most part aren’t keen to sell. So if they aren’t keen to sell, it’s not really a problem that they can’t sell. If we did have lots of investors who wanted to sell, we could potentially look at changing the structure to allow for it.

- Dividends – This is also something that gets mentioned from time to time. Why would people invest if they don’t get paid dividends? I think this is just a bit of ignorance around how high growth companies work. If people are investing in high growth companies, they shouldn’t be expecting a dividend. Money should be put back into the expensive task of continuing to grow the business. If it’s a stable and profitable company then dividends might be on the agenda. If it’s a stable company that’s not growing and not profitable then this is just a big problem and if people are investing in companies like that, then they probably aren’t good investments.

Advice for breweries doing crowdfunding

We’ve only done one round and a pretty small one, but I figure our experience can possibly help others. So here are a few things I’d be thinking about.

Equity Crowdfunding can be great if it’s the right fit for your business, your product and audience. It was a perfect fit for us. We love engaging our audience in what we do and I love chatting to investors, and keeping them involved in the business. It’s also a really healthy transparent way to raise money.

Before Equity Crowdfunding was available in Australia, there was no information anywhere on how to raise money. We literally had no idea how to do it and it wasn’t really easy to work out how to do it, short of watching episodes of Shark Tank or looking at overseas equity crowdfunding rounds. It’s much better now since equity crowdfunding became legal in Australia.

That said, it’s not for everybody. If you have that mindset to include people in your journey and you have a consumer-facing product that people can get excited about, then I think those are good signs.

Be honest during the process, it’s not a good fit for companies who are trying to hide things. Raising money in this way in such a public way for a business that isn’t going well is a very big risk and it hurts the Equity Crowdfunding brand and the industry.

Don’t be too ambitious with your future projections. When we did ours, we didn’t go into too much detail about future projections. We relied on our past performance and simply said our goal was to build a second brewery to continue growing. The second brewery was well on the way already and there was no way we weren’t going to hold up our end of the deal.

Make sure you value your company high enough. It’s hard to build a great brand and a great business and you should value it, especially if your brand is growing quickly. What feels like a high valuation now, might seem miniscule in a few years time if you are growing super quickly.

Don’t just raise more money for the sake of it, the more you raise the more equity you are giving up. Only raise what you need. If your company is growing quickly, it will be worth a lot more down the track, so you don’t want to maximise the raise at a small valuation.

Don’t focus too much on investor rewards and discounts. Try to get investors on board who want to see the business going well and aren’t investing just to get discounts. If they are investing for that reason and the discounts are too generous, you are just pre-selling a lot of debt. There are better ways to raise money.

If you have any questions feel free to ask them below, or in our Ambassador Group.